Blog Details

Categories

RECENT POSTS

Long Term SIP And The Power Of Compounding

The world of investing can seem complex and intimidating. Picking stocks, timing the market, and navigating financial jargon can be overwhelming for beginners. However, there's a powerful tool available to everyone Systematic Investment Plans (SIP) in mutual funds.

SIP offer a simple yet effective way to invest regularly and build wealth over the long term. But the true magic of SIP lies in the concept of compounding, which allows your money to grow exponentially. This blog will explain SIP, compounding, and how they work together to turn your savings into a substantial corpus.

SIP Investing Made Easy

Imagine this instead of worrying about investing a lump sum or trying to predict market fluctuations, you can set up a plan to invest a fixed amount, say Rs.1,000, every month. This is the essence of SIP. You invest a manageable amount at regular intervals, typically monthly, into a chosen mutual fund scheme.

Here's why SIP are a great fit for many investors:

• Discipline:

SIP instil a habit of regular saving and investing. You don't need a large sum to start, and the automated nature of SIP ensures consistency.

• Rupee-Cost Averaging:

Market fluctuations are inevitable. SIP help you average out the cost of your investment units. You buy more units when the price is low and fewer units when the price is high, balancing out the overall cost per unit.

• Accessibility:

SIPs are perfect for anyone looking to start their investment journey, regardless of their income level. With low minimum investment amounts, they make investing inclusive.

Compounding : Your Money Growing on Money

Now, let's delve into the magic behind long-term SIP compounding. Imagine earning interest on your investment. But, with compounding, you also earn interest on the interest you've already earned! This creates a snowball effect, where your returns grow exponentially over time.

Think of it like this if you invest Rs.1,000 every month and earn a hypothetical return of 10% annually, your investment grows not only on the initial amount but also on the accumulated returns. Over time, the returns themselves become a significant contributor to your portfolio's growth.

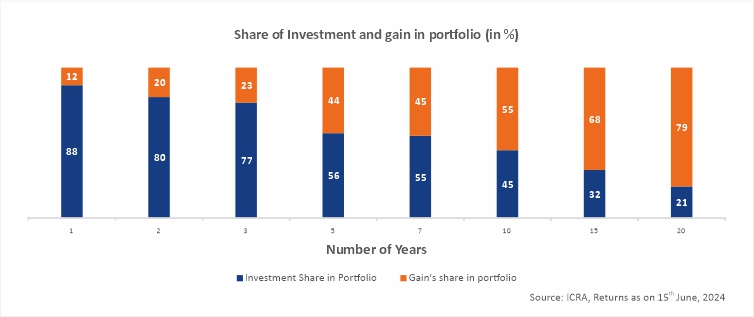

The SIP Graph Explained: Visualizing Compounding

The graph depicts the magic of compounding in action. The x-axis represents the number of years you invest, and the y-axis shows the share of your investment and gains in the total portfolio value (as a percentage).

Here's a breakdown of what the graph tells us:

Initial Years:

In the beginning the blue area representing your initial investment dominates. The orange area, representing your gains, is still relatively small.

The Shift:

As time progresses, something remarkable happens. The orange area representing gains starts to outpace the blue area of your initial investment. This is the power of compounding kicking in!

The Long-Term Advantage

The key takeaway from the graph is simple: the longer you stay invested in SIP, the more pronounced the impact of compounding becomes. While the initial investment forms the base, your gains take centre-stage over time, driving significant growth in your portfolio value.

SIP and Compounding: A Winning Formula

By combining the discipline of SIP with the power of compounding, you create a winning formula for long-term wealth creation. Here's why this approach is so effective:

• Time is Your Ally:

The longer your investment horizon, the greater the impact of compounding. Starting early and staying invested for the long term allows compounding to work its magic and significantly increase your returns.

• Focus on Consistency:

Don't get discouraged by market fluctuations. SIP help you ride out market ups and downs through rupee-cost averaging. The key is to stay consistent with your investments.

• Reap the Rewards:

Over time, your SIP can accumulate a substantial corpus, helping you achieve your financial goals, whether it's a dream retirement, a child's education, or a down payment on a house.

Investing Made Simple: Getting Started with SIPs

Ready to embark on your wealth building journey with SIP? Here are some steps to get you started:

• Define Your Goals:

Determine your investment goals and the time frame you have to achieve them. This will help you choose the right SIP plan.

• Choose Your SIP:

Research different mutual fund schemes based on your risk tolerance and investment horizon.

• Start Investing:

Set up an SIP with your chosen mutual fund house. Most investment platforms offer online SIP registration, making it convenient to start.

Remember SIP are a long-term investment strategy. Don't get discouraged by short-term market movements. Stay focused on your goals, maintain consistent investments, and witness the power of compounding work its wonders over time. Happy investing!

LEAVE A REPLY

Prudent Corporate Advisory Services Limited

AMFI Registered Mutual Fund Distributor

CIN: L91120GJ2003PLC042458

AMFI Reg No.: ARN-9992 (Date of initial Registration; 02 September 2003; Current validity of ARN -26 August 2025)| SEBI Stock Broker Reg.: INZ000293634 | SEBI Depository Reg.: IN DP CDSL: IN-DP-477-2020 | NSE Member Id: 90209| BSE Member Id: 6733 | SEBI Research Analyst Reg.: INH000018115 |SEBI Investment Advisor Reg.: INA000004906 | PFRDA POP Reg.: POP 10092018 | IRDA Corporate Agent Reg. No. CA0869

* Mutual Fund investments are subject to market risks. Please read all scheme related documents carefully before investing.

Prudent Corporate Advisory Services Ltd. (ARN-9992) makes no warranties or representations, express or implied, on products offered through FundzBazar.com. It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Terms and conditions of the website are applicable. Copyright © 2024 Prudent Corporate Advisory Services Ltd.

FundzBazar Login

FundzBazar Login Broking Login

Broking Login

.jpg)

.png)

0 Responses